Apteros Trading – NADRO Methodology by Merritt Black

$499.00 Original price was: $499.00.$12.00Current price is: $12.00.

Merritt Black Apteros Trading NADRO Methodology Course [Instant Download]

1️⃣. What is NADRO Methodology?

NADRO Methodology is an elite-level futures trading course developed on a professional trading desk by Merritt Black, drawing from 15 years of institutional experience.

This comprehensive system breaks down trading into five essential components: Narrative, Acceptance, Developing Value, Rhythm, and Order Flow.

The course provides 23+ hours of instruction plus 19 hours of bonus content, teaching you the exact strategies used daily at Apteros Trade Desk for consistent profitability.

? PROOF OF COURSE

2️⃣. What you will learn in NADRO Methodology?

NADRO Methodology teaches you institutional-level futures trading strategies that are actively used in professional trading. Here’s what you’ll master:

- Mental Framework: Learn why traders fail and how to develop a professional trading mindset

- Market Dynamics: Master auction market theory and market profile analysis

- Trade Execution: Develop precise entry and exit strategies using rhythm and acceptance

- Order Flow: Learn to read market strength through footprint charts and delta analysis

- Risk Management: Master professional trade management techniques

- Documentation: Learn proper trading documentation and performance analysis

By the end of this course, you’ll have a complete framework for trading futures at an institutional level.

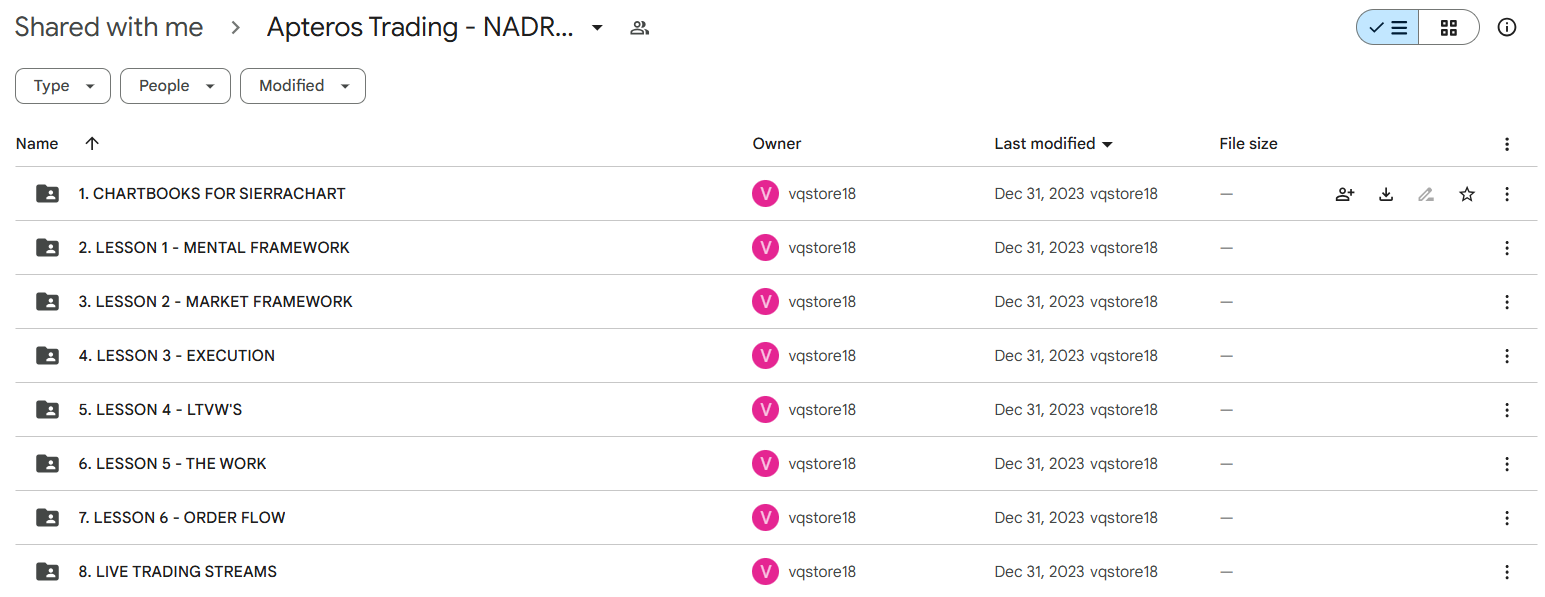

3️⃣. NADRO Methodology Course Curriculum:

The course gives you everything needed to trade like a professional. You’ll get 23+ hours of training that shows you exactly how successful traders work in the real market. The course curriculum includes:

✅ CHARTBOOKS FOR SIERRACHART:

- NADRO_CL

- NADRO_ES

- README ( file doc )

✅ LESSON 1: MENTAL FRAMEWORK

3+ hours of on-demand video content covering:

- Introduction to Mental Framework

- Most Traders Fail (Why?)

- The Natural Human Trader

- The Evolved Human Trader

- How Process Fits In

- Warning!

- Developing the Mental Framework

- Bonus – Homework

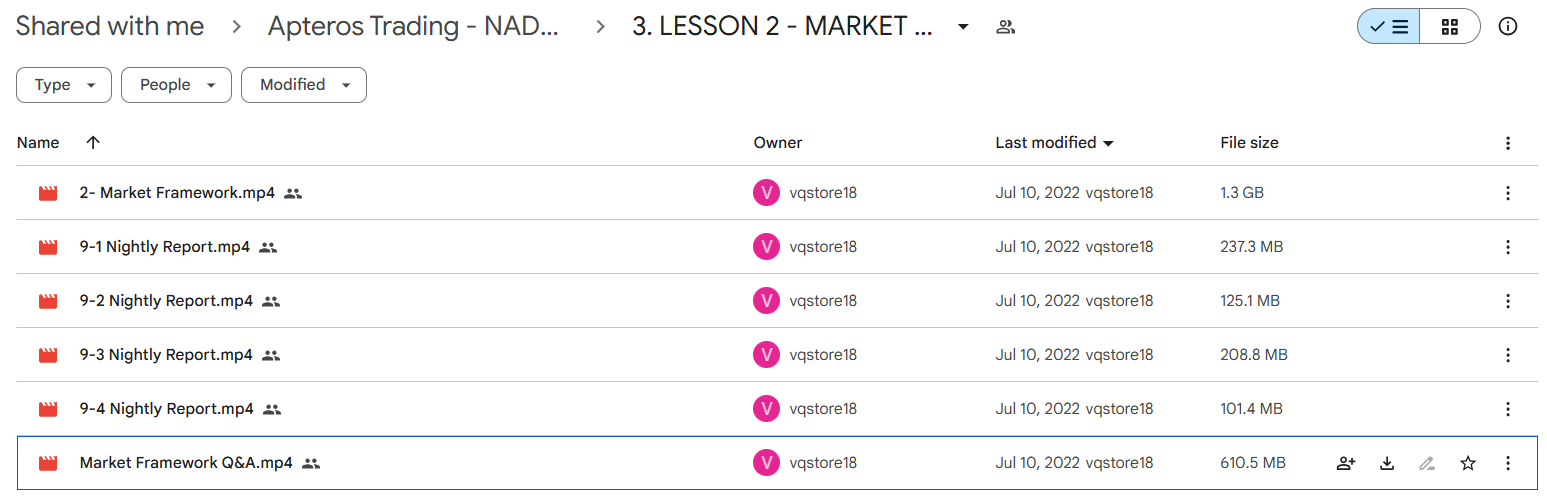

✅ LESSON 2: MARKET FRAMEWORK

5+ hours of video content including:

- Auction Market Theory and its applications

- The 10 Laws of Market Dynamics you MUST Know

- Charting & Getting Set up to Trade

- Market Profile Basics

- The Laws of Market Dynamics – Real Examples

- How & Why we use Composite Profiles

- Developing Narratives & Hypos (if-then scenarios)Developing Your Ability To Profile Effectively

✅ LESSON 3: EXECUTION & TRADE MANAGEMENT

3.5+ hours of video content including:

- Introduction to Execution

- Rhythm for Entries

- The Importance of Acceptance

- Developing Value

- Risk and Trade Management

- Building on Mental & Market Framework + Homework

- Bonus: Execution Video Q&A

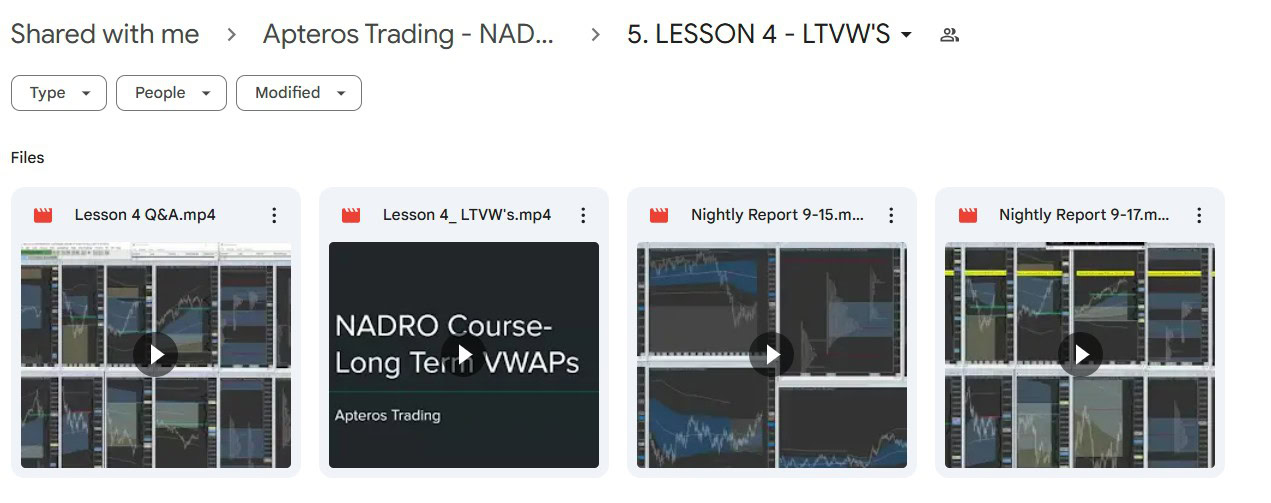

✅ LESSON 4: LONG TERM VWAPs

4+ hours of video content including:

- Developing the Full Narrative Using Higher Time Frame

- How to use Multiple Long Term VWAPs

- Handling LTVW Extremes

- Ranking & Distilling Narratives

- Handling Confluence and Dissonance

- Live Trade Examples

- Nightly Reports + Video Q&A

✅ LESSON 5: THE WORK

3 hours of video content including:

- The Work and Documentation

- Preparing for the Trading Day (Prep)

- How to Journal

- How to Conduct a Daily Review

- Longer-Term Reviews

- How to Use Statistics to Improve Your Trading

- Skills to Develop This Week

✅ LESSON 6: ORDER FLOW

3 hours of video content about order flow trading:

- The Basics of Order Flow

- Identifying Strength and Weakness

- The Tools We’ll Use

- Cumulative Delta / Footprint Trading

- Contextual Order Flow

- Identifying Strong Buyers and Absorption

- Delta Levels

- How and When to Use the Footprint Chart

- Live Examples Using Order Flow

✅ BONUS: LIVE TRADING STREAMS ( 5 Video )

Each lesson includes real examples and practice assignments to build your skills.

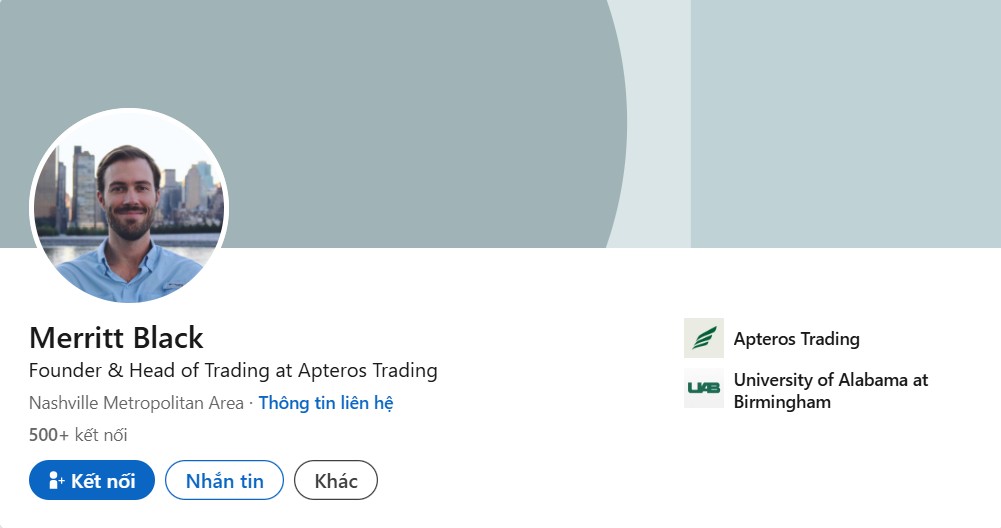

4️⃣. Who is Merritt Black?

Merritt Black is a veteran futures trader with over 15 years of experience in trading futures, currencies, commodities, and equities.

As the former Head of Futures and Commodities at SMB Capital, a prestigious New York City proprietary trading firm, Merritt developed and mentored numerous successful traders.

His expertise has been recognized across the industry, leading to regular appearances on the Futures Radio Show with Anthony Crudele, the AlphaMind Podcast, and Amplify Trading. He founded Apteros Trading to share his proven trading methodology with serious traders.

Currently based in Nashville, Merritt combines his passion for trading with diverse interests including music, triathlon, golf, and oil painting. His multifaceted approach to personal development reflects in his comprehensive trading methodology.

5️⃣. Who should take Merritt Black Course?

The NADRO Methodology is designed for serious traders committed to mastering institutional-level trading. This course is ideal for:

- Professional Aspirants who want to join proprietary trading desks or start their own funds

- Active Traders looking to elevate their trading with institutional-grade strategies

- Futures Specialists seeking a comprehensive methodology for consistent profitability

- Dedicated Students ready to commit to a proven, process-driven approach

This course requires dedication and serious commitment to trading excellence. If you’re looking for quick profits or “hot tips,” this isn’t the right program for you.

6️⃣. Frequently Asked Questions:

Q1: How long does it take to master the NADRO Methodology?

Mastering the NADRO Methodology typically takes 3-6 months of dedicated study and practice. The course provides 23+ hours of core content plus 19 hours of bonus material. Students should expect to spend additional time practicing concepts, reviewing trades, and developing their skills through the provided homework assignments.

Q2: What trading instruments does the NADRO Methodology work best with?

The NADRO Methodology works primarily with futures markets, where institutional order flow is most prevalent. While the principles can apply to other markets, the strategies are optimized for futures trading, particularly in liquid markets like ES, NQ, CL, and other major futures contracts.

Q3: Do I need previous trading experience to take this course?

While previous trading experience is helpful, it’s not required. However, you should understand basic market concepts and terminology. The course starts with fundamental concepts and progressively builds to advanced strategies. What’s most important is your commitment to learning and following a professional process.

Q4: What makes NADRO different from other trading methodologies?

NADRO is unique because it’s developed from actual institutional trading experience. It combines five essential elements (Narrative, Acceptance, Developing Value, Rhythm, and Order Flow) into a cohesive system. Unlike typical retail trading courses, NADRO teaches professional-grade analysis and execution methods used on actual trading desks.

Q5: How much capital should I have to start trading with NADRO?

Trading futures requires adequate capital for proper risk management. While specific amounts vary by broker, a recommended starting account size is $25,000-$50,000 for futures trading. This allows for proper position sizing and risk management as taught in the course. However, you can begin learning and practicing the methodology with a simulator while building your capital.

Be the first to review “Apteros Trading – NADRO Methodology by Merritt Black” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.