Breaking Into Wall Street – BIWS Platinum Package (2022)

$1,197.00 Original price was: $1,197.00.$119.00Current price is: $119.00.

Breaking Into Wall Street BIWS Platinum Package ( 2022) Course [Instant Download]

1️⃣. What is Breaking Into Wall Street BIWS Platinum Package:

Breaking Into Wall Street BIWS Platinum Package is a comprehensive financial modeling and investment banking training program designed by industry experts.

The package includes eight extensive sections covering everything from basic Excel skills to advanced financial modeling, making it perfect for aspiring finance professionals.

This all-in-one program combines practical skills with real-world case studies, helping you master the technical skills needed for investment banking careers.

? PROOF OF COURSE

2️⃣. What you will learn in BIWS Platinum Package:

The BIWS Platinum Package offers comprehensive training in financial modeling and investment banking skills. Here’s what you’ll master:

- Excel & VBA Mastery: Advanced Excel techniques and VBA programming for efficient financial analysis

- Financial Modeling: Complete 3-statement modeling, DCF analysis, and valuation techniques

- Real Estate & REIT Modeling: Specialized modeling for real estate investments and REITs

- Investment Banking Skills: Interview preparation, networking strategies, and career guidance

- PowerPoint Pro: Create professional pitch books and presentations

- Bank & Financial Institution Modeling: Specialized modeling for banking sector

By the end of this course, you’ll have the technical skills and practical knowledge needed to excel in investment banking interviews and jobs.

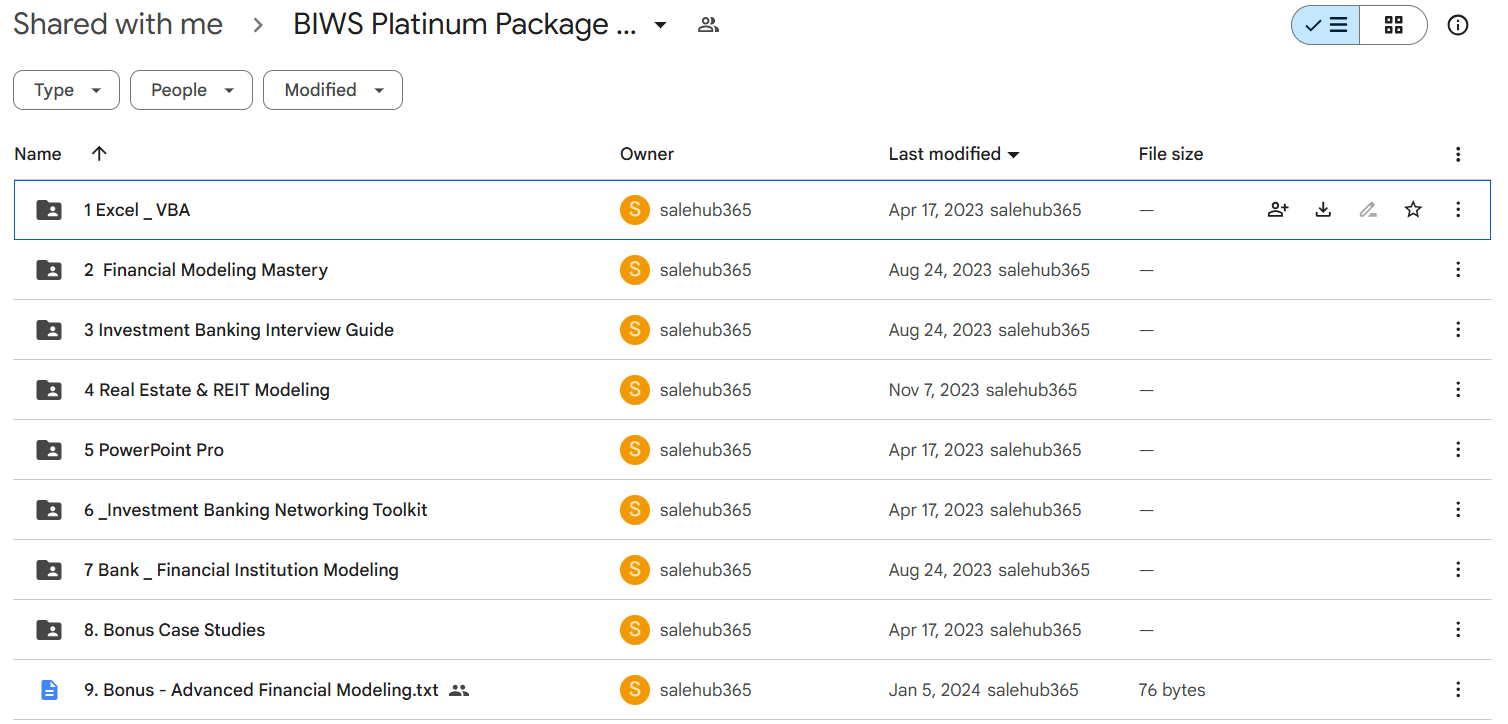

3️⃣. BIWS Platinum Package Course Curriculum:

The BIWS Platinum Package offers a complete journey from basic Excel skills to advanced financial modeling. Each section builds on the previous one, creating a solid foundation for your finance career. The course curriculum includes:

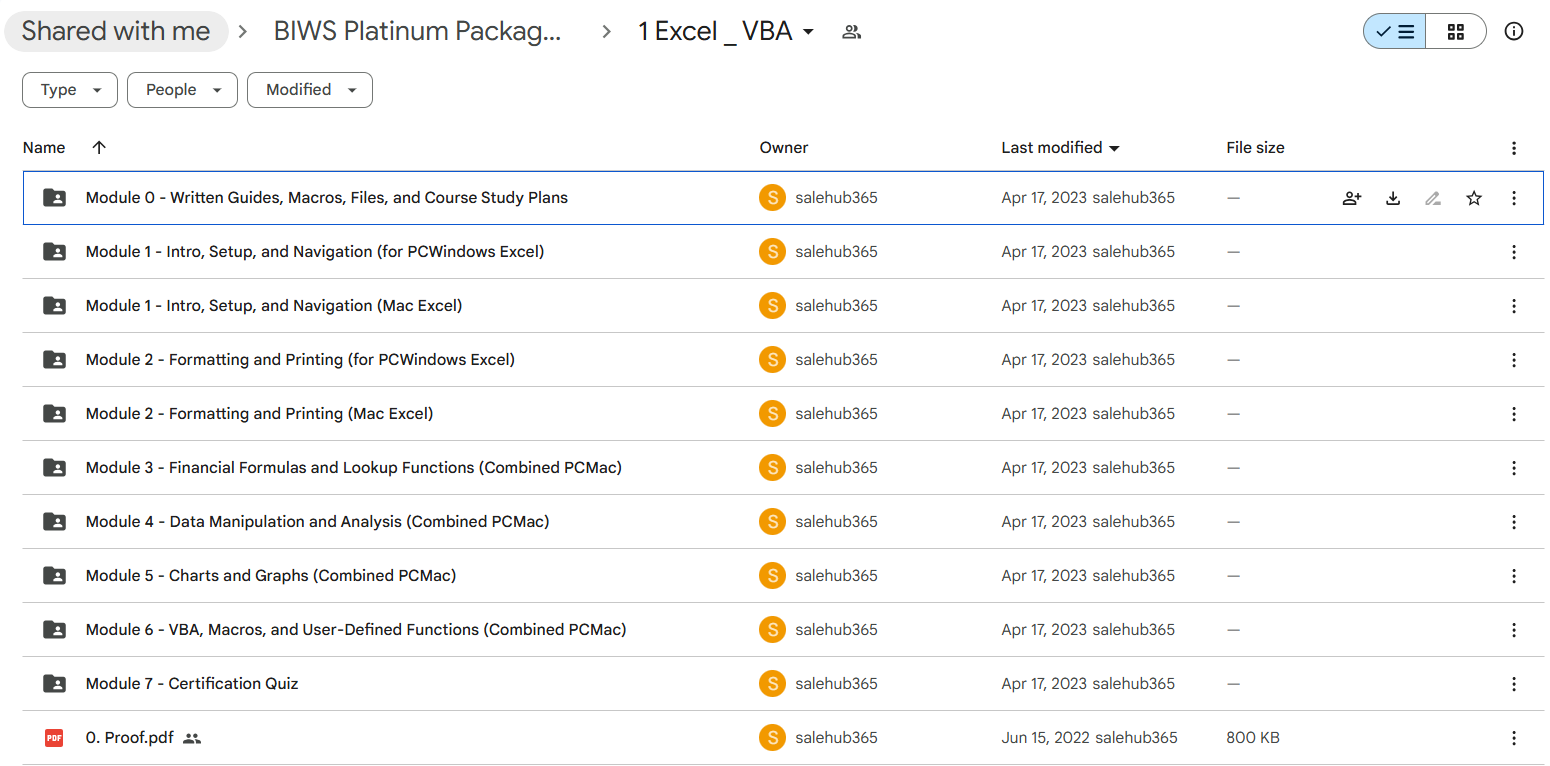

✅ Section 1: Excel_VBA

- Module 1: Written Guides, Macros, Files, and Course Study Plans

- Module 2: Intro, Setup, and Navigation (for PCWindows Excel)

- Module 3: Intro, Setup, and Navigation (Mac Excel)

- Module 4: Formatting and Printing (for PCWindows Excel)

- Module 5: Formatting and Printing (Mac Excel)

- Module 6: Financial Formulas and Lookup Functions (Combined PCMac)

- Module 7: Data Manipulation and Analysis (Combined PCMac)

- Module 8: Charts and Graphs (Combined PCMac)

- Module 9: VBA, Macros, and User-Defined Functions (Combined PCMac)

- Module 10: Certification Quiz

- Proof ( pdf )

✅ Section 2: Financial Modeling Mastery

- Module 1: Financial Modeling Overview and Core Concepts

- Module 2: Accounting Concepts, the Financial Statements, and Interview Questions

- Module 3: More Advanced Accounting

- Module 4: 60-Minute and 2-Hour 3-Statement Modeling Case Studies (Toro and Atlassian)

- Module 5: 3-Hour 3-Statement Modeling Test and Debt vs. Equity Case Study (EasyJet)

- Module 6: Equity Value, Enterprise Value, and Valuation Multiples

- Module 7: 3-Hour Valuation and DCF Case Study from Blank Sheet

- Module 8: 1-Week, Open-Ended Valuation and DCF Case Study

- Module 9: Valuation Interpretation, Real-Life Usage, and Supplemental Methodologies

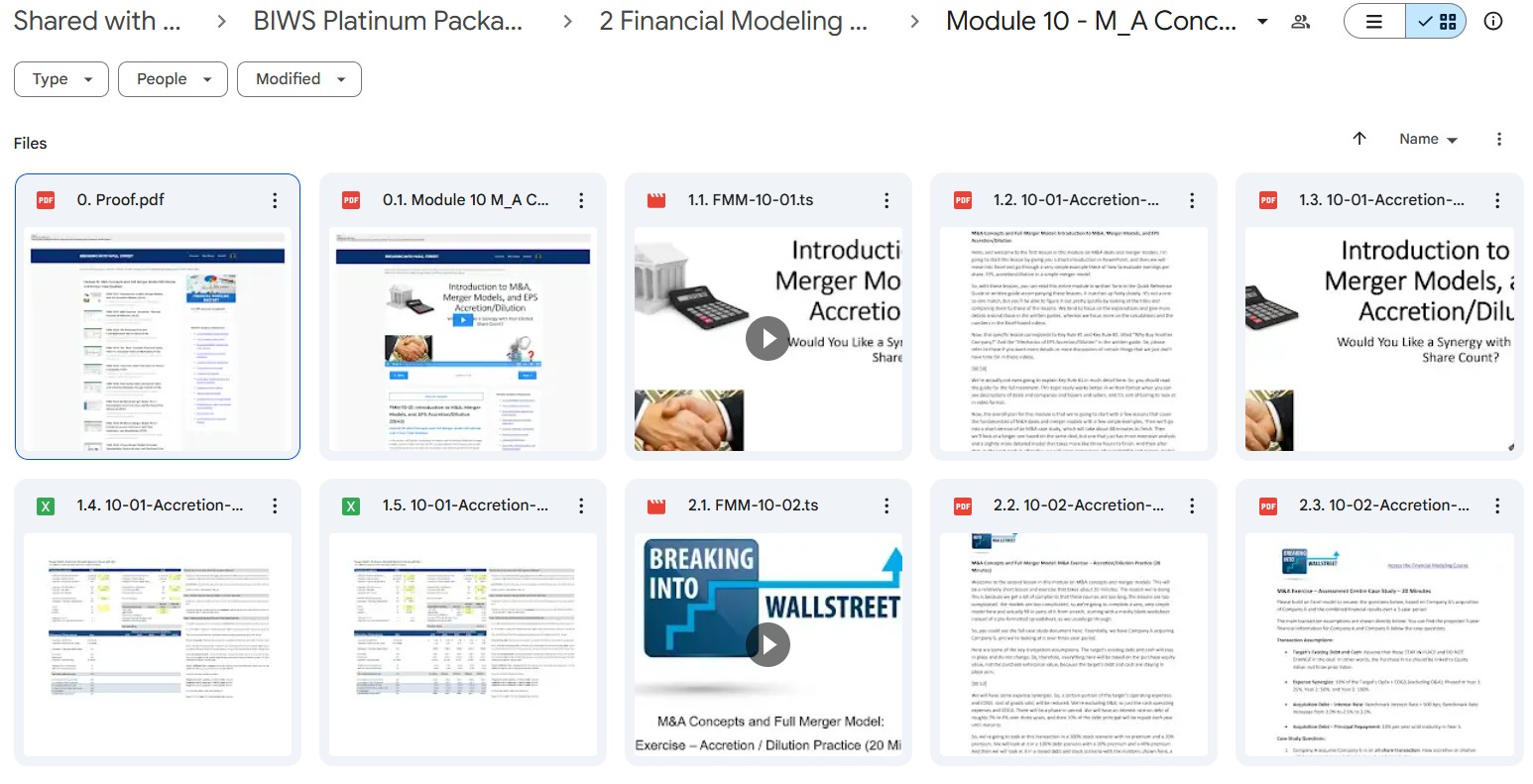

- Module 10: M_A Concepts and Full Merger Model

- Module 11: More Advanced M_A Deals and Merger Models

- Module 12: Leveraged Buyout Concepts and Simpler LBO Models

- Module 13: More Complex LBO Models and Case Studies

- Module 14: Private Companies, IPOs, and Reverse Mergers

- Module 15: Debt, Equity _ Convertibles

- Module 16: Certification Quiz

- Proof ( pdf )

✅ Section 3: Investment Banking Interview Guide

- Module 1: Action Plan and Quick Start Guide

- Module 2: How to Tell Your Story (Resume Walkthrough Tutorials)

- Module 3: Fit Questions and Deal and Market Discussions

- Module 4: Technical Questions and Answers

- Module 5: Interactive Quiz Questions and Answer Keys

- Module 6: Case Study Exercises

- Proof ( pdf )

✅ Section 4: Real Estate & REIT Modeling

- Module 1: Real Estate Overview and Short Case StudiesModeling Tests

- Module 2: 4-Hour Office Development Modeling Test (100 Bishopsgate)

- Module 3: 2-Hour Hotel Acquisition _ Renovation Modeling Test (Jumeirah Beach Hotel)

- Module 4: 3-Hour Multifamily Acquisition and Credit Case Study (The Lyric)

- Module 5: 4-Hour OfficeRetail Acquisition _ Renovation Modeling Test (45 Milk Street)

- Module 6: 2-Hour Pre-Sold Condo Development Modeling Test (Heritage Cyrela)

- Module 7: 4-Hour (or 1-Week) REIT Valuation Modeling Test (AvalonBay)

- Module 8: 2-Hour REIT Debt vs. Equity Case Study (SPH REIT)

- Module 9: 3-Hour REIT M_A and Merger Model Case Study (Digital Realty_DuPont Fabros)

- Module 10: 2.5-Hour REIT Leveraged Buyout and LBO Model Case Study (Blackstone_Pure Industrial Real Estate Trust)

- Module 11: Certification Quiz

- Proof ( pdf )

✅ Section 4: Real Estate & REIT Modeling

- Module 1: Real Estate Overview and Short Case StudiesModeling Tests

- Module 2: 4-Hour Office Development Modeling Test (100 Bishopsgate)

- Module 3: 2-Hour Hotel Acquisition _ Renovation Modeling Test (Jumeirah Beach Hotel)

- Module 4: 3-Hour Multifamily Acquisition and Credit Case Study (The Lyric)

- Module 5: 4-Hour OfficeRetail Acquisition _ Renovation Modeling Test (45 Milk Street)

- Module 6: 2-Hour Pre-Sold Condo Development Modeling Test (Heritage Cyrela)

- Module 7: 4-Hour (or 1-Week) REIT Valuation Modeling Test (AvalonBay)

- Module 8: 2-Hour REIT Debt vs. Equity Case Study (SPH REIT)

- Module 9: 3-Hour REIT M_A and Merger Model Case Study (Digital Realty_DuPont Fabros)

- Module 10: 2.5-Hour REIT Leveraged Buyout and LBO Model Case Study (Blackstone_Pure Industrial Real Estate Trust)

- Module 11: Certification Quiz

- Proof ( pdf )

✅ Section 5: PowerPoint Pro

- Module 1: Overview and PowerPoint Setup

- Module 2: Shapes, Slides, Alignment, and Distribution

- Module 3: The Slide Master and Sections for Organization

- Module 4: Using Excel and Word Data, Pictures, and Tables

- Module 5: Finishing Touches

- Module 6: Presentation and Pitch Book Examples

- Module 7: Company and Deal Profiles

- Module 8: Practice Exercises

- Proof ( pdf )

✅ Section 6: Investment Banking Networking Toolkit

- Module 1: Course Overview, Firm Database, and Networking Action Plans

- Module 2: Informational Interviews

- Module 3: Cold Emails

- Module 4: Cold Calls

- Module 5: Information Sessions

- Module 6: Weekend Trips

- Module 7: (Bonus) The Art of Effective Email

- Module 8: (Bonus) Using LinkedIn Effectively

- Module 9: (Bonus) Networking Success Case Studies

- Module 10: The Investment Banking Networking Quiz

- Proof ( pdf )

✅ Section 7: Bank _ Financial Institution Modeling

- Module 1: Bank Overview Accounting, Valuation, and Regulations

- Module 2: Bank Operating Model

- Module 3: Bank Valuation

- Module 4: Bank M_A and Merger Models

- Module 5: Bank Growth Equity Deals

- Module 6: Bank Buyout Deals

- Module 7: Certification Quiz

- Module 8: Insurance Overview (Bonus Module)

✅ Section 8: Bonus Case Studies

- Module 1: Bonus Standalone Lessons (Accounting, M_A and LBO Models)

- Module 2: Silver Lake_Dell Leveraged Buyout – Extended Case Study

- Proof ( pdf )

✅ Bonus – Advanced Financial Modeling ( file

Each section includes practical exercises and real-world case studies to ensure you can apply what you learn in actual work situations.

4️⃣. Who is Brian DeChesare?

Brian DeChesare is the founder of Breaking Into Wall Street (BIWS), a leading financial modeling and investment banking training platform.

With extensive experience in investment banking and technology, Brian started his career at major financial institutions before founding BIWS. His unique combination of technical expertise and real-world experience makes him an invaluable instructor.

Since launching BIWS, Brian has helped thousands of students land jobs in investment banking and finance. His teaching methodology focuses on practical, real-world applications rather than theoretical concepts.

Under his leadership, BIWS has become one of the most respected names in financial education, training professionals who now work at top investment banks, private equity firms, and hedge funds worldwide.

5️⃣. Who should take Breaking Into Wall Street Course?

The BIWS Platinum Package is designed for ambitious individuals pursuing careers in finance. This comprehensive program is perfect for:

- Aspiring Investment Bankers seeking to master technical skills and interview preparation

- Finance Students wanting to supplement their academic knowledge with practical skills

- Career Changers looking to transition into investment banking or finance

- Financial Analysts aiming to advance their modeling and valuation skills

- Real Estate Professionals interested in mastering financial modeling for properties and REITs

The BIWS Platinum Package provides the foundation you need to succeed in investment banking, private equity, or other finance careers.

6️⃣. Frequently Asked Question:

Q1: How long does it take to become proficient in financial modeling?

Achieving proficiency in financial modeling typically takes 3-6 months of dedicated practice. Most analysts spend 2-3 hours daily working on models. Key areas like 3-statement modeling can be mastered in 4-6 weeks, while advanced concepts like M&A and LBO modeling require additional 2-3 months.

Q2: What are the essential skills needed for investment banking interviews?

Investment banking interviews require strong technical knowledge, including accounting fundamentals, DCF analysis, and valuation methods. You should also master behavioral questions, market knowledge, and your “story.” Most successful candidates spend 40-60 hours preparing technical questions and 15-20 hours on behavioral preparation.

Q3: How much do entry-level investment banking analysts earn?

First-year investment banking analysts at major banks earn base salaries of $85,000-$100,000, plus bonuses of $80,000-$120,000. Total compensation typically ranges from $170,000-$220,000. Regional boutiques offer slightly lower packages, usually 15-20% less than bulge bracket banks.

Q4: What makes a strong real estate financial model?

A strong real estate financial model includes detailed rent roll analysis, operating expense projections, and development costs. The model should account for market-specific factors, financing terms, and exit scenarios. Successful models typically include sensitivity analysis for key variables like cap rates and rental growth.

Q5: How important is Excel proficiency in financial careers?

Excel proficiency is crucial in finance roles, with professionals spending 50-70% of their workday using Excel. Key skills include financial functions, pivot tables, and VBA macros. Most investment banks require candidates to pass Excel-based technical assessments during interviews.

Be the first to review “Breaking Into Wall Street – BIWS Platinum Package (2022)” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.