No BS Day Trading – Basic & Intermediate

$84.00 Original price was: $84.00.$12.00Current price is: $12.00.

John Grady No BS Day Trading Course [Instant Download]

1️⃣. What is No BS Day Trading:

No BS Day Trading Basic & Intermediate teaches you how to trade using order flow and depth of market (DOM) analysis. The course shows you how to read market movements and execute profitable trades.

Through video tutorials and real trade examples, you’ll learn professional scalping strategies for treasury futures and E-Mini S&P 500.

Based on John Grady’s experience as a Chicago prop trader, the course focuses on practical DOM trading techniques that work in real market conditions.

? PROOF OF COURSE

2️⃣ What you will learn in No BS Day Trading:

Basic & Intermediate shows you how to trade like a professional using order flow strategies. Here’s what you’ll learn:

- DOM Trading: Read depth of market data to find the best entry and exit points

- Market Mechanics: See how large orders move prices and affect the market

- Multi-Market Analysis: Learn to watch multiple markets at once, like treasury and S&P markets

- Scalping Strategies: Master quick trading methods used by professional traders

- Jigsaw Platform Setup: Create an effective trading workspace for better results

- Trade Management: Learn how to protect your money and manage risks properly

After completing the course, you’ll know the same trading methods used by successful professional traders in Chicago’s trading firms.

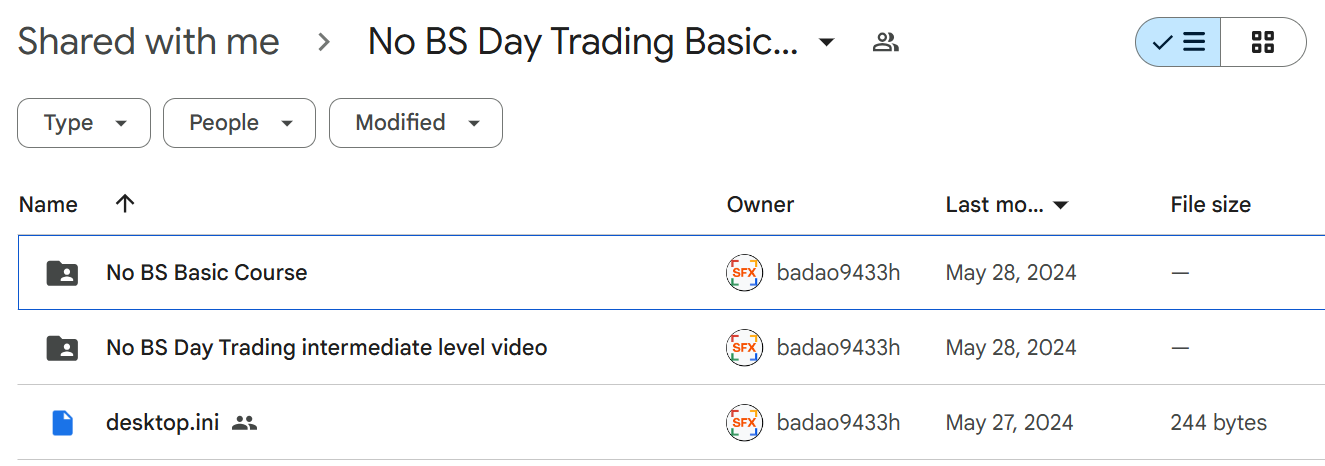

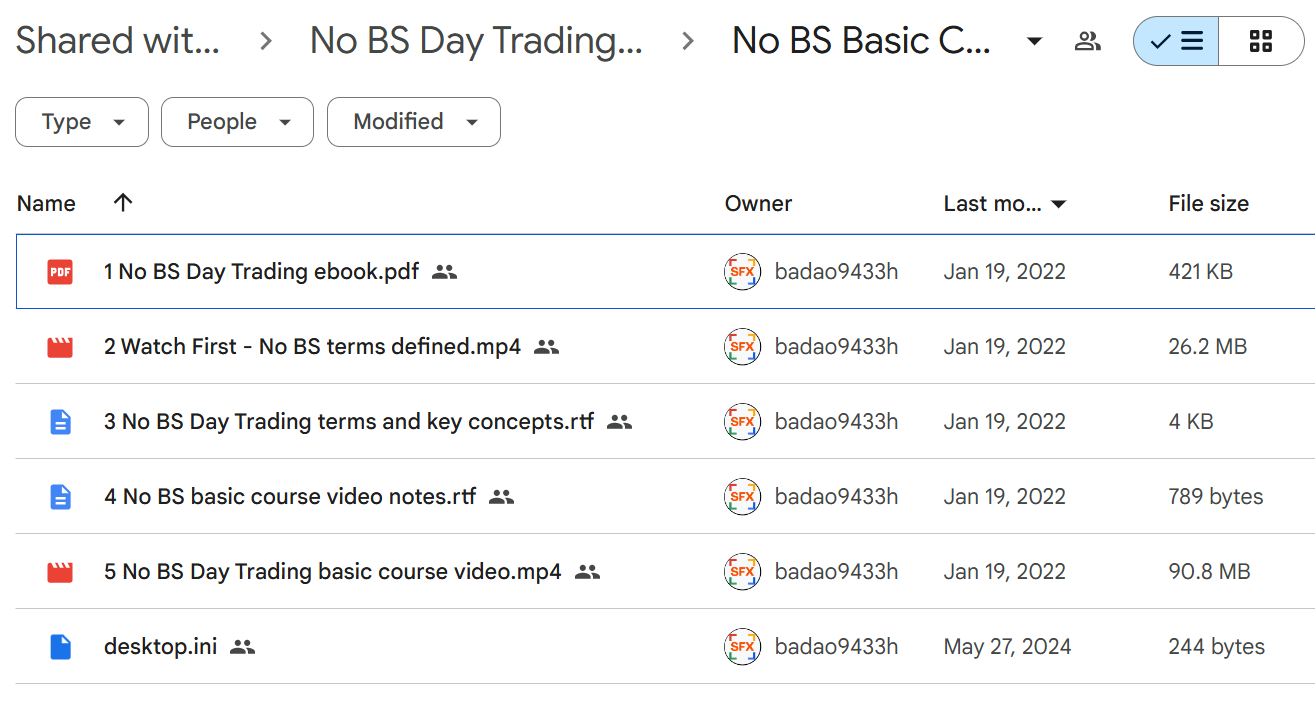

3️⃣. No BS Day Trading Course Curriculum:

The Basic & Intermediate course takes you from basic to advanced order flow trading. Each lesson builds on the previous one, making it easy to learn step by step. The course curriculum includes:

✅ Module 1: No BS Basic Course

- No BS Day Trading ebook

- Watch First – No BS terms defined

- No BS Day Trading terms and key concepts

- No BS basic course video notes

- No BS Day Trading basic course video

✅ Module 2: No BS Day Trading intermediate level video

- No BS Day Trading intermediate level video

- No BS Day Trading intermediate video notes

You’ll learn exactly how professional traders read the market and make trading decisions. The course focuses on practical skills you can use right away in your trading.

4️⃣. Who is John Grady?

John Grady built his career trading at a top Chicago trading firm. He trades treasury futures, bond futures, and E-Mini S&P 500 futures.

He learned trading by watching real order flow on DOM platforms. This gave him deep insight into how big trades move the market. Unlike other teachers, he shows exactly how institutional orders affect price.

Grady focuses on what works in real trading, not theory. His methods come from years of actual trading in Chicago’s markets.

Through No BS Day Trading, he teaches traders how markets really work. His direct teaching style and focus on practical trading has made him a respected educator.

5️⃣. Who should take John Grady Course?

Basic & Intermediate is for traders who want to learn real professional trading methods. The course helps:

- New Traders wanting to start with proven trading techniques

- Chart Traders looking to add order flow trading to their skills

- Active Traders ready to use professional trading methods

- Daily Traders wanting better results with scalping and day trading

This course teaches real trading based on market experience. If you want quick profits or trading robots, look elsewhere. This is about learning actual trading skills used in professional trading firms.

6️⃣. Frequently Asked Questions:

Q1: What is order flow trading and why is it important?

Order flow trading shows you how big players move the market by watching their buying and selling patterns. Unlike chart patterns, order flow gives real-time insights into market moves. Professional traders use it because it shows actual trading activity, not lagging indicators.

Q2: How much capital do I need to start day trading futures?

Most futures brokers require $2,000-$5,000 minimum for a day trading account. For E-mini S&P 500 futures, start with at least $10,000 for proper risk management. Treasury futures typically need $7,000-$15,000 initial capital.

Q3: What is DOM trading and how does it work?

DOM (Depth of Market) shows pending buy and sell orders at different price levels. It lets you see where large traders are placing orders and how they affect price. This helps you spot potential price moves before they happen.

Q4: How long does it take to learn order flow trading?

Most traders need 3-6 months of daily practice to get comfortable with order flow trading. Focus first on one market (like E-mini S&P 500) before adding others. Successful traders typically spend 2-3 hours daily studying market patterns.

Q5: What’s the difference between scalping and regular day trading?

Scalping aims for many small profits ($50-$200) per trade with very short hold times (seconds to minutes). Regular day trading holds positions longer (minutes to hours) for larger moves. Scalpers typically make 10-20 trades daily versus 3-5 for day traders.

Be the first to review “No BS Day Trading – Basic & Intermediate” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.