Tradingriot Bootcamp & Blueprint 3.0

$490.00 Original price was: $490.00.$29.00Current price is: $29.00.

Tradingriot Bootcamp & Blueprint 3.0 Course [Instant Download]

1️⃣. What is Bootcamp & Blueprint 3.0:

Tradingriot Bootcamp & Blueprint 3.0 teaches you how to trade futures markets using orderflow analysis and market theory.

The program covers market microstructure, price action patterns, and auction market theory for both day and swing trading success.

You get 26 detailed videos with ongoing updates, covering everything from basic concepts to advanced trading strategies in crypto and traditional futures markets.

? PROOF OF COURSE

2️⃣. What you will learn in Bootcamp & Blueprint 3.0:

The Tradingriot Bootcamp & Blueprint 3.0 delivers advanced trading knowledge through comprehensive video lessons. Here’s what you’ll master:

- Market Analysis: Learn market microstructure, orderflow, and auction market theory for accurate trade decisions

- Trading Strategies: Master day trading, swing trading, and long-term position techniques

- Risk Management: Develop solid risk control and position sizing methods

- Platform Mastery: Get hands-on training with Sierra Chart, ExoCharts, and TradingView

- Professional Tools: Master footprint charts, volume profile, and delta indicators

- Trade Psychology: Learn daily preparation and journaling techniques for consistent results

This course transforms complex trading concepts into practical, actionable strategies for both crypto and traditional futures markets.

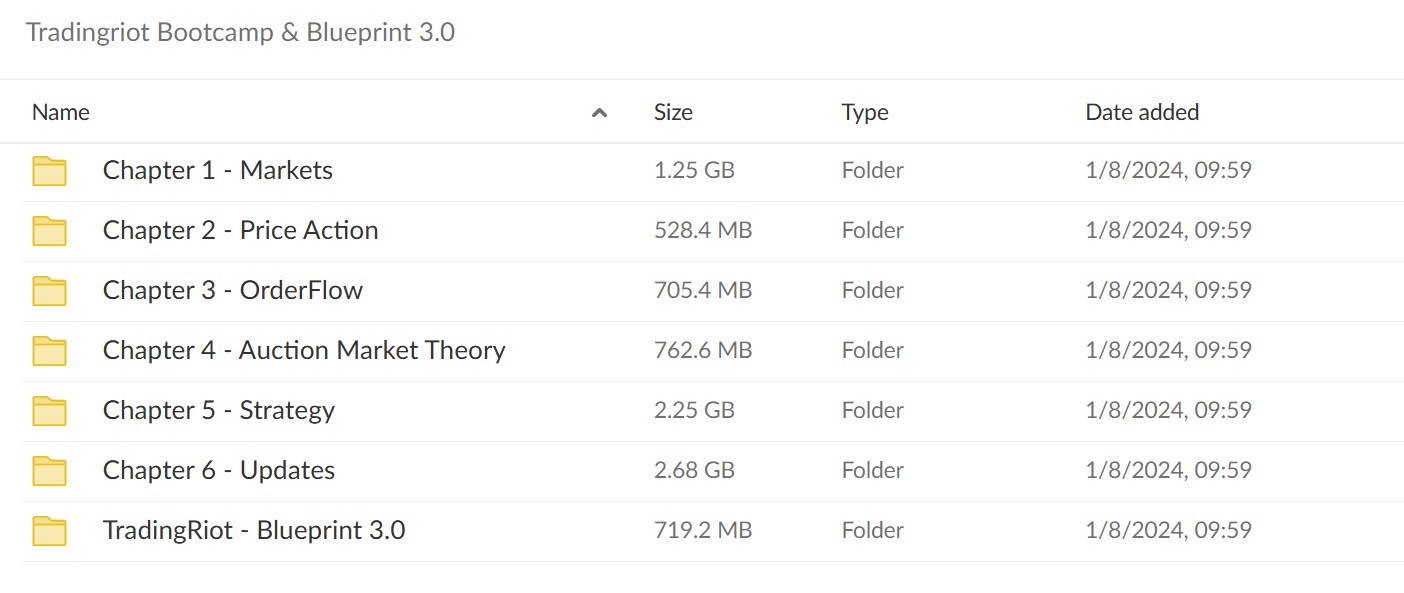

3️⃣. Bootcamp & Blueprint 3.0 Course Curriculum:

Tradingriot Bootcamp & Blueprint 3.0 covers everything you need to succeed in futures trading. Let’s look at what you’ll learn in each chapter:

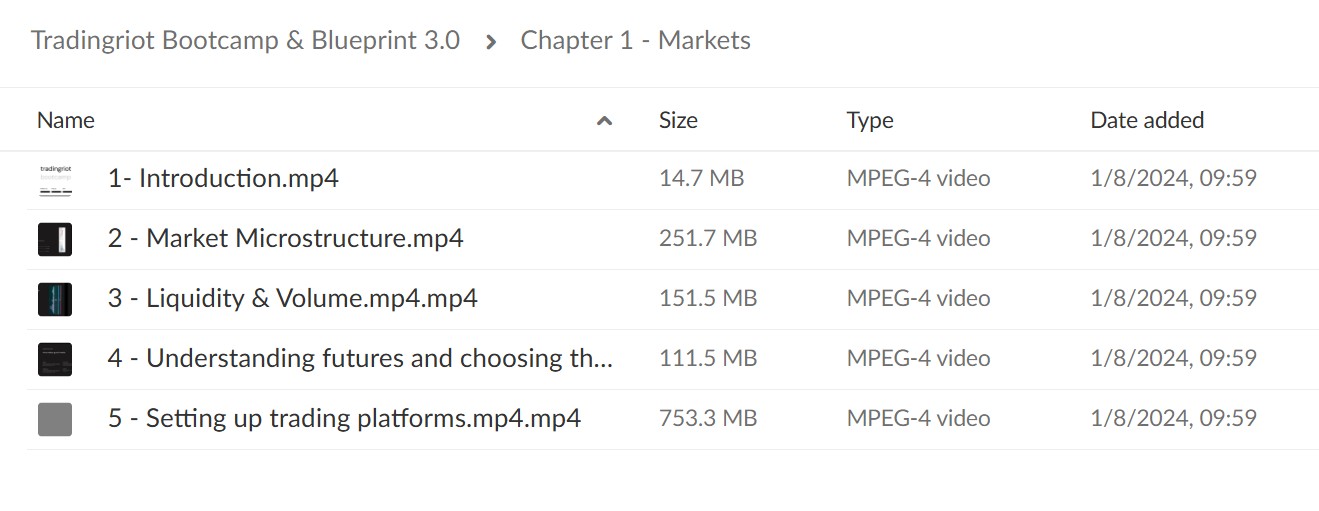

✅ Chapter 1: Markets

- Introduction

- Market Microstructure

- Liquidity & Volume

- Understanding futures and choosing the right market

- Setting up trading platforms

✅ Chapter 2: Price Action

- Price Action Principles

- Key price structures

- Execution patterns

- Bias determining candlestick patterns

- Navigating timeframes and utilizing non-time based charts

✅ Chapter 3: OrderFlow

- Understanding orderflow

- Delta and its indicators

- Footprint charts

- Connecting orderflow to price action

✅ Chapter 4: Auction Market Theory

- Chapter 4: Auction market theory

- Market Profile

- Volume Profile

- Volume indicators

- Connecting AMT with orderflow and price action

✅ Chapter 5: Strategy

- Failed Swing

- Cluster

- Quasimodo

- Risk Management

- Intraday strategy

- Medium-term swing strategy

- Long term swing strategy

- Trading Plan

- Daily preparation

- Journaling

- Closing Words

✅ Chapter 6: Updates

- Nuances of day trading crypto

- Revisiting cumulative volume delta

- Revisiting VWAP

- Setting up ATAS platform

This curriculum combines theory with practical application, helping you become a confident and skilled futures trader.

4️⃣. What is Tradingriot?

Tradingriot actively trades futures across CME, Eurex, and crypto markets. They teach based on real trading experience since 2020.

Their trading method combines volume profiling, orderflow analysis, and price action. This system works in all market conditions and timeframes.

They focus purely on teaching through the Trading Blueprint and Bootcamp, with no ads or other products.

Students get ongoing support through email and one-on-one calls after completing the course.

5️⃣. Who should take Tradingriot Course?

The Tradingriot Bootcamp & Blueprint 3.0 helps you master futures trading through detailed video lessons. This course is perfect for:

- Active Traders who want to learn professional tools and trading strategies

- Crypto Traders ready to start trading traditional futures markets

- Technical Traders looking to learn orderflow and auction market theory

- Day Traders who want better trade execution and risk management

- Swing Traders who need strategies for longer timeframe trades

Whether you’re just starting or already trading, this course teaches you everything through easy-to-follow videos. Each lesson breaks down complex concepts into simple steps.

6️⃣. Frequently Asked Questions:

Q1: What is futures trading and how does it work?

Futures trading lets you buy or sell assets at a future date for a set price. You can trade stocks, commodities, or crypto futures with leverage. This means you only need a small deposit to control a larger position in the market.

Q2: Do I need a lot of money to start futures trading?

You can start with $2,000-$5,000. Micro futures contracts like the Micro E-mini S&P 500 are good for beginners. They require less capital but still let you practice real trading strategies.

Q3: Is futures trading more risky than stock trading?

Futures trading has higher risk due to leverage, but also more opportunities. You can make (or lose) money faster than stocks. Good risk management and proper training are essential for success.

Q4: How can I learn futures trading safely?

Start with paper trading (practice account) while learning the basics. Focus on one market first, master reading price action and orderflow. Keep your position sizes small when you start real trading.

Q5: Which is better – day trading or swing trading futures?

Day trading means closing all trades by day’s end, requiring more time at your screen. Swing trading holds positions for days or weeks, needing less active management. Both can be profitable – choose based on your schedule and trading style.

Be the first to review “Tradingriot Bootcamp & Blueprint 3.0” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.