Wallstreet Trapper – Wallstreet Trappin

Wallstreet Trapper Wallstreet Trappin Course [Instant Download]

1️⃣. What is Wallstreet Trappin:

Wallstreet Trappin teaches you how to build wealth through strategic stock market investing.

The course shows you practical ways to research stocks, find valuable companies, and set realistic investment goals using street-smart methods.

You get lifetime access to learn fundamental analysis and real investing strategies that help create generational wealth in the stock market.

? PROOF OF COURSE

2️⃣. What you will learn in Wallstreet Trappin:

Wallstreet Trappin course teaches you proven strategies to build wealth in the stock market. Here’s what you’ll master:

- Stock Research: Learn to read company financials and spot valuable stocks for investing

- Build Wealth: Use compound interest and dividends to create steady income

- Market Know-How: Understand different market sectors and how to make money in each

- Smart Investing: Build and grow your stock portfolio the right way

- Play it Safe: Avoid common mistakes that can cost you money

The course breaks down stock market concepts into simple steps anyone can follow and use right away. You’ll learn to invest like a Trapper using tested methods that work.

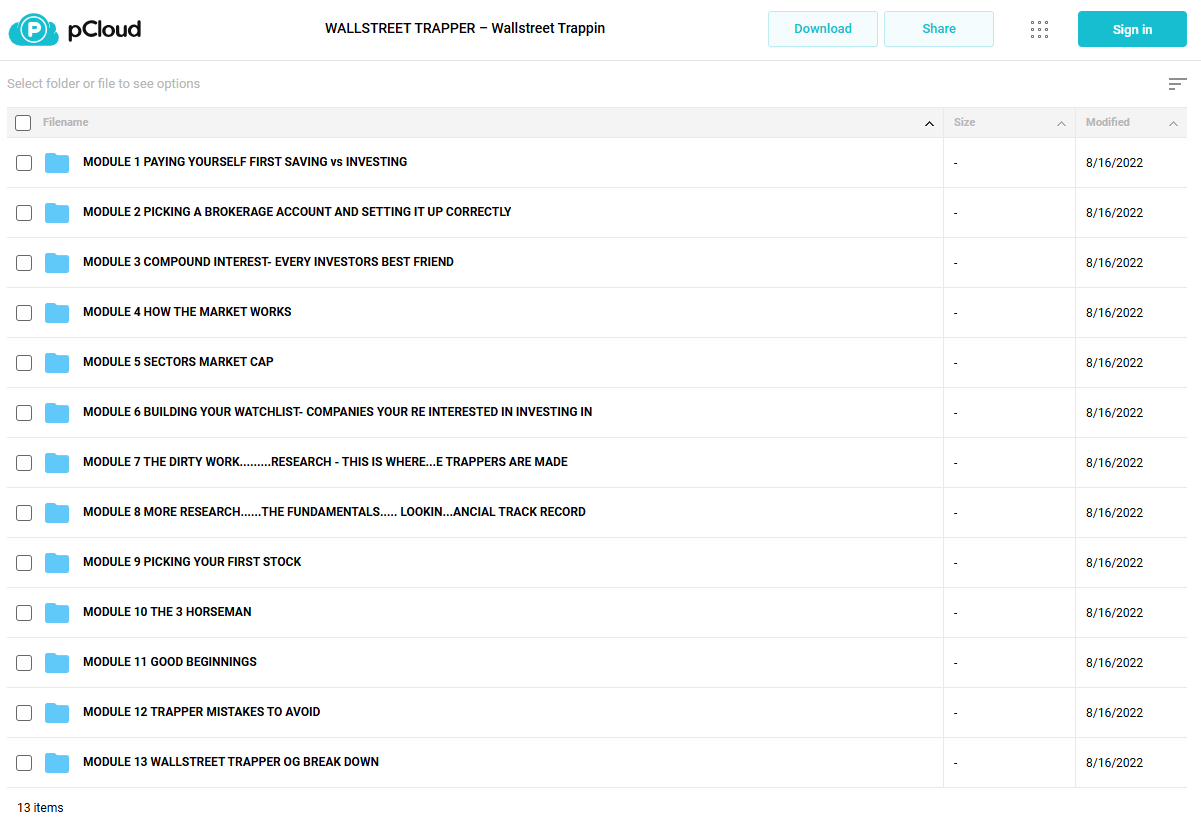

3️⃣. Wallstreet Trappin Course Curriculum:

Wallstreet Trappin breaks down stock market investing into simple, easy-to-follow steps. Each module builds your knowledge from basic to advanced investing skills, using real examples and proven methods. The course curriculum includes:

- Module 1: PAYING YOURSELF FIRST SAVING vs INVESTING

- Module 2: PICKING A BROKERAGE ACCOUNT AND SETTING IT UP CORRECTLY

- Module 3: COMPOUND INTEREST- EVERY INVESTORS BEST FRIEND

- Module 4: HOW THE MARKET WORKS

- Module 5: SECTORS MARKET CAP

- Module 6: BUILDING YOUR WATCHLIST- COMPANIES YOUR RE INTERESTED IN INVESTING IN

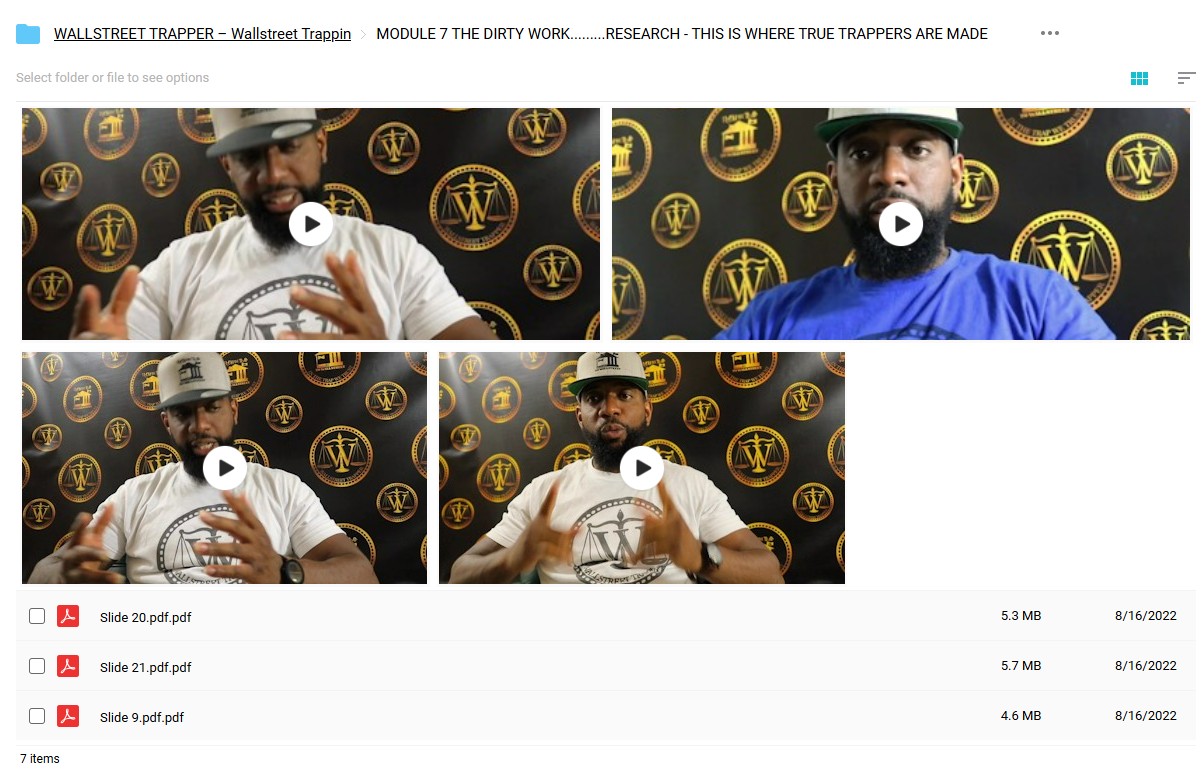

- Module 7: THE DIRTY WORK……..RESEARCH – THIS IS WHERE…E TRAPPERS ARE MADE

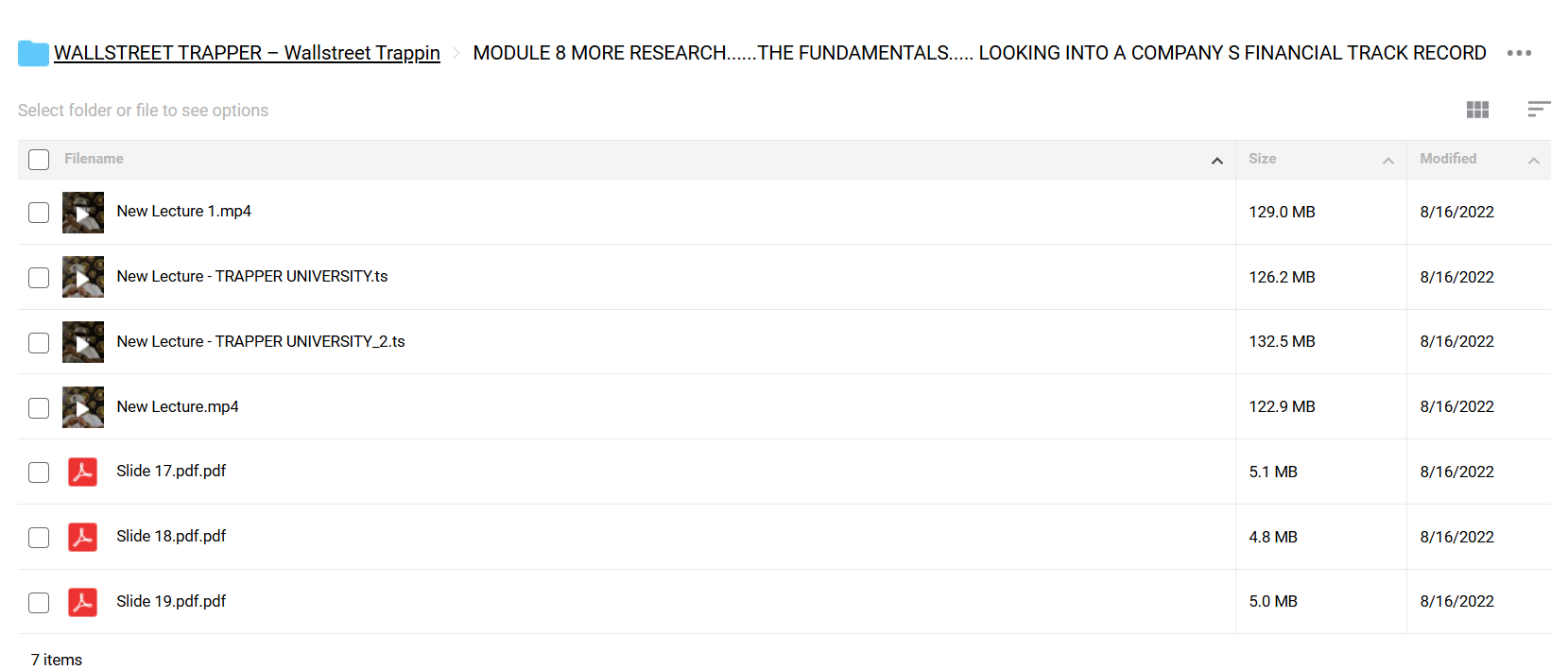

- Module 8: MORE RESEARCH……THE FUNDAMENTALS…..LOOKIN…ANCIAL TRACK RECORD

- Module 9: PICKING YOUR FIRST STOCK

- Module 10: THE 3 HORSEMAN

- Module 11: GOOD BEGINNINGS

- Module 12: TRAPPER MISTAKES TO AVOID

- Module 13: WALLSTREET TRAPPER OG BREAK DOWN

Total course time is about 2.5 hours of focused, practical learning. Every module includes video sessions that show you exactly what to do, making complex investing ideas easy to understand.

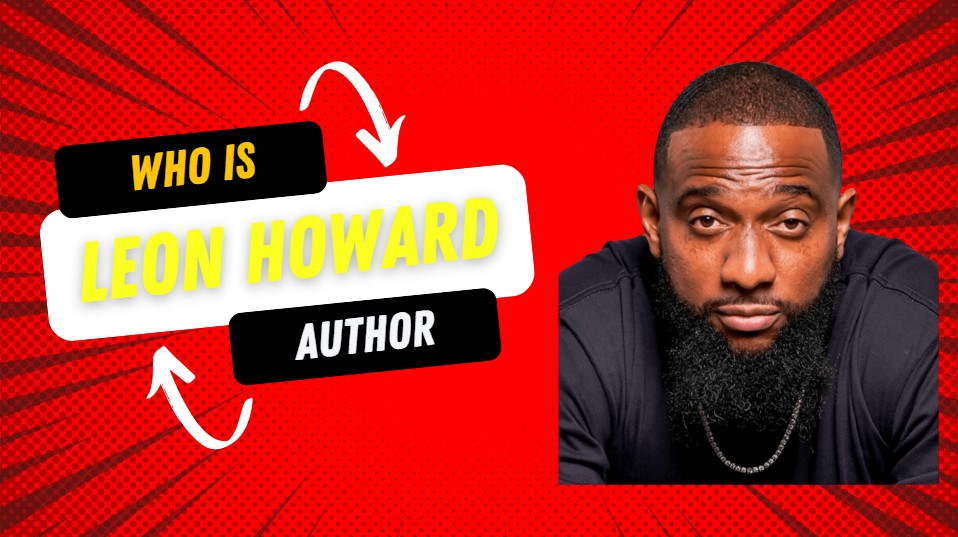

4️⃣. Who is Leon Howard?

Leon Howard (Wallstreet Trapper) is a financial teacher from New Orleans who changed his life through the stock market. He learned about finance and investing during his 10-year prison time, then made it his mission to teach others.

His company, From the Trap to Wallstreet, now helps over 700,000 Trappers learn about wealth building through stocks. He makes investing easy to understand, especially for the Black community.

Wallstreet Trapper has become a trusted voice in teaching finance. He shows people how to build generational wealth through the stock market, gaining a strong following on social media.

He teaches through courses, ebooks, and a private members group, helping people create wealth through smart stock market investing.

5️⃣. Who should take Wallstreet Trapper Course?

Wallstreet Trappin course is perfect for anyone serious about building wealth through the stock market. It’s specifically designed for:

- Beginning Investors who want to learn stock market basics from scratch

- Active Traders looking to develop a long-term wealth building strategy

- Working Professionals seeking to grow their wealth through smart stock investments

- Community Leaders who want to spread financial literacy in their circles

- Aspiring Investors ready to move beyond savings accounts into stock market investing

The course provides lifetime access and ongoing updates, making it valuable for anyone committed to learning regardless of their starting point.

6️⃣. Frequently Asked Questions:

Q1: How much money do I need to start investing in stocks?

You can start with $100 or less. Most brokers offer fractional shares now, so you can buy parts of expensive stocks. What matters most is starting early – even $50 a month can grow into significant wealth through compound interest.

Q2: Can I lose all my money in stocks?

Not if you invest wisely. Spread your money across different stocks or index funds instead of putting everything in one company. Most investors who stay in the market for 10+ years end up profitable, even through market ups and downs.

Q3: Which stocks are best for beginners?

Start with index funds that track the S&P 500 – they give you instant diversity across 500 top companies. For individual stocks, pick stable companies you know well, like Apple or Microsoft, that pay dividends and have strong growth history.

Q4: How often should I check my stocks?

For long-term investing, checking once a month is enough. Daily checking can lead to emotional decisions and panic selling. Focus on your investment goals and stick to your plan. The stock market rewards patience.

Q5: When is the best time to buy stocks?

The best time is when you have money to invest, regardless of market conditions. Trying to time the market usually leads to missed opportunities. Regular investing (like monthly) helps you buy at different price points and reduce risk.

Be the first to review “Wallstreet Trapper – Wallstreet Trappin” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.