Advanced MMXM – The Inner Circle Dragons

$365.00 Original price was: $365.00.$12.00Current price is: $12.00.

The Inner Circle Dragons Advanced MMXM Course [Instant Download]

1️⃣. What is Advanced MMXM:

The Inner Circle Dragons Advanced MMXM teaches you how to trade using Market Maker Models (MMXM) and ICT methods.

AK, an ICT private charter student, breaks down market maker concepts through structured video lessons.

You’ll master high-probability setups, accumulation/distribution cycles, and algorithmic strategies to improve your trading success.

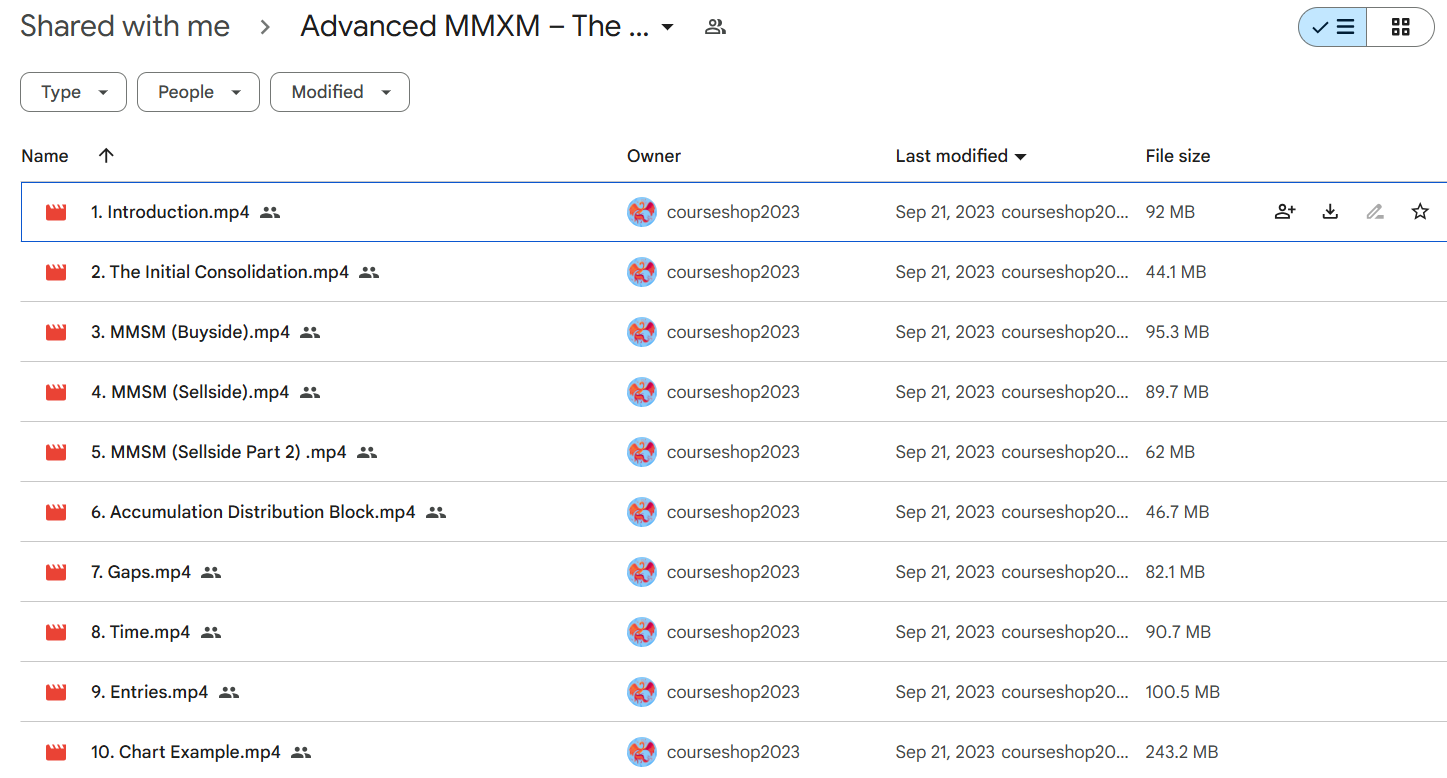

? PROOF OF COURSE

2️⃣. What you will learn in Advanced MMXM:

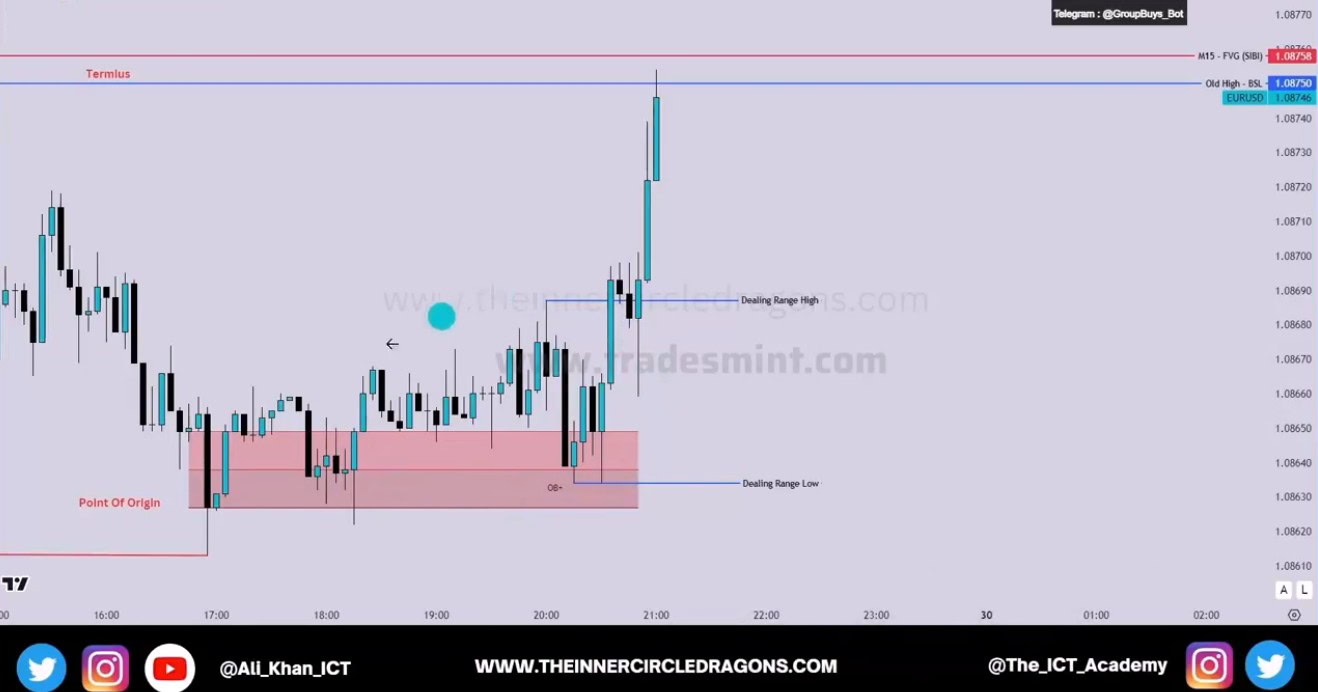

Advanced MMXM course unlocks the deep mechanics of Market Maker Models. Here’s what you’ll master:

- Market Structure Analysis: Learn to identify and trade MMSM, MMBM, and advanced MMXM patterns

- High-Probability Setups: Master orderblock/FVG formations and turtle soup entries

- Strategic Implementation: Apply accumulation/distribution cycle flows and range calibration

- Advanced Concepts: Understand swing deviations, gap analysis, and smart money reversals

- Practical Application: Real chart breakdowns and time-based analysis

- Risk Management: Develop personal models and precise entry strategies

By the end of this course, you’ll have a thorough understanding of market maker dynamics and practical trading strategies.

3️⃣. Advanced MMXM Course Curriculum:

The Advanced MMXM course is organized in a step-by-step format to help you understand market maker strategies. Each lesson builds on the previous one with clear examples. The course curriculum includes:

- Introduction [about 10min]

- The Initial Consolidation [about 5min30]

- MMSM (Buyside) [about 11min]

- MMSM (Sellside) [about 11min]

- MMSM (Sellside Part 2) [about 6min]

- Accumulation Distribution Block [about 5min]

- Gaps [about 9min]

- Time [about 11min]

- Entries [about 12min30]

- Chart Example [about 21min30]

Every lesson includes detailed videos and practical examples so you can apply these strategies in your own trading. The course helps you move from understanding concepts to actually trading them.

4️⃣. What is The Inner Circle Dragons?

The Inner Circle Dragons (ICD) teaches ICT methods and market maker models for trading.

AK, a private student of ICT, spent 5 years studying and mastering algorithmic trading and market maker models.

ICD turns complex trading ideas into clear, practical strategies. They help traders understand how institutional traders think and move in markets.

AK has gathered and organized scattered ICT concepts into one complete course, making advanced trading methods easier to learn.

5️⃣. Who should take The Inner Circle Dragons Course?

The Advanced MMXM course helps traders who want to improve their market understanding and results. This course is perfect for:

- Active Traders who want to learn how institutional traders operate

- Experienced Traders looking to understand market maker models better

- ICT Students who want to master MMXM strategies

- Full-time Traders ready to use advanced trading methods

You should know basic trading concepts before starting this course. Be ready to learn and practice new trading strategies consistently.

6️⃣. Frequently Asked Questions:

Q1: How much can I make trading with Market Maker Models?

Skilled MMXM traders aim for 5-15% monthly returns using 1-2% risk per trade. Most successful traders make consistent profits after 6-12 months of practice. Risk-reward ratios typically range from 1:3 to 1:5 per trade.

Q2: What’s the success rate of Market Maker trading?

MMXM traders who follow proper risk management see 60-70% win rates. Most profitable traders take 2-3 trades daily and win 6-7 trades out of 10. Key is following institutional order flow, not forcing trades.

Q3: Is Market Maker trading better than indicator trading?

Yes. Market Makers control 90% of market volume. MMXM trading follows real money flow instead of lagging indicators. You trade with banks and institutions rather than against them, giving higher probability setups.

Q4: How much money do I need to start MMXM trading?

Start with $2,000-$5,000 minimum. Risk 1% per trade ($20-50 on a $2,000 account). Small accounts under $1,000 make proper risk management difficult and often lead to overtrading.

Q5: Which timeframes work best for Market Maker trading?

Higher timeframes (4H and Daily) show clearest institutional moves. Start analysis on Daily, find setups on 4H, enter on 1H. Top traders focus 80% on higher timeframes where big money leaves clearest footprints.

Be the first to review “Advanced MMXM – The Inner Circle Dragons” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.