The Wall Street Quants Bootcamp

$5,997.00 Original price was: $5,997.00.$14.00Current price is: $14.00.

Wall Street Quants The Wall Street Quants Bootcamp Course [Instant Download]

1️⃣. What is The Wall Street Quants Bootcamp:

The Wall Street Quants Bootcamp teaches you how to build profitable trading algorithms like top hedge funds. Senior quants from Point72, Millennium, and SIG share their actual trading strategies.

You’ll learn Python coding and statistical arbitrage to create automated trading systems. The course covers everything from basic coding to advanced portfolio optimization.

The program matches real quant firm training, making it perfect for both beginners and experienced traders who want to master systematic trading.

? PROOF OF COURSE

2️⃣. What you will learn in The Wall Street Quants Bootcamp:

The Wall Street Quants Bootcamp gives you a solid foundation in quant finance and algorithmic trading. The course teaches:

- Learn Python coding for trading and finance

- Build statistical arbitrage systems like major hedge funds use

- Master portfolio management and risk control methods

- Test trading strategies with real market data

- Create automated crypto trading systems

- Use our Python library to trade with real money

After finishing, you’ll know how to research, build, and run professional trading strategies. The skills you learn are the same ones used at top trading firms today.

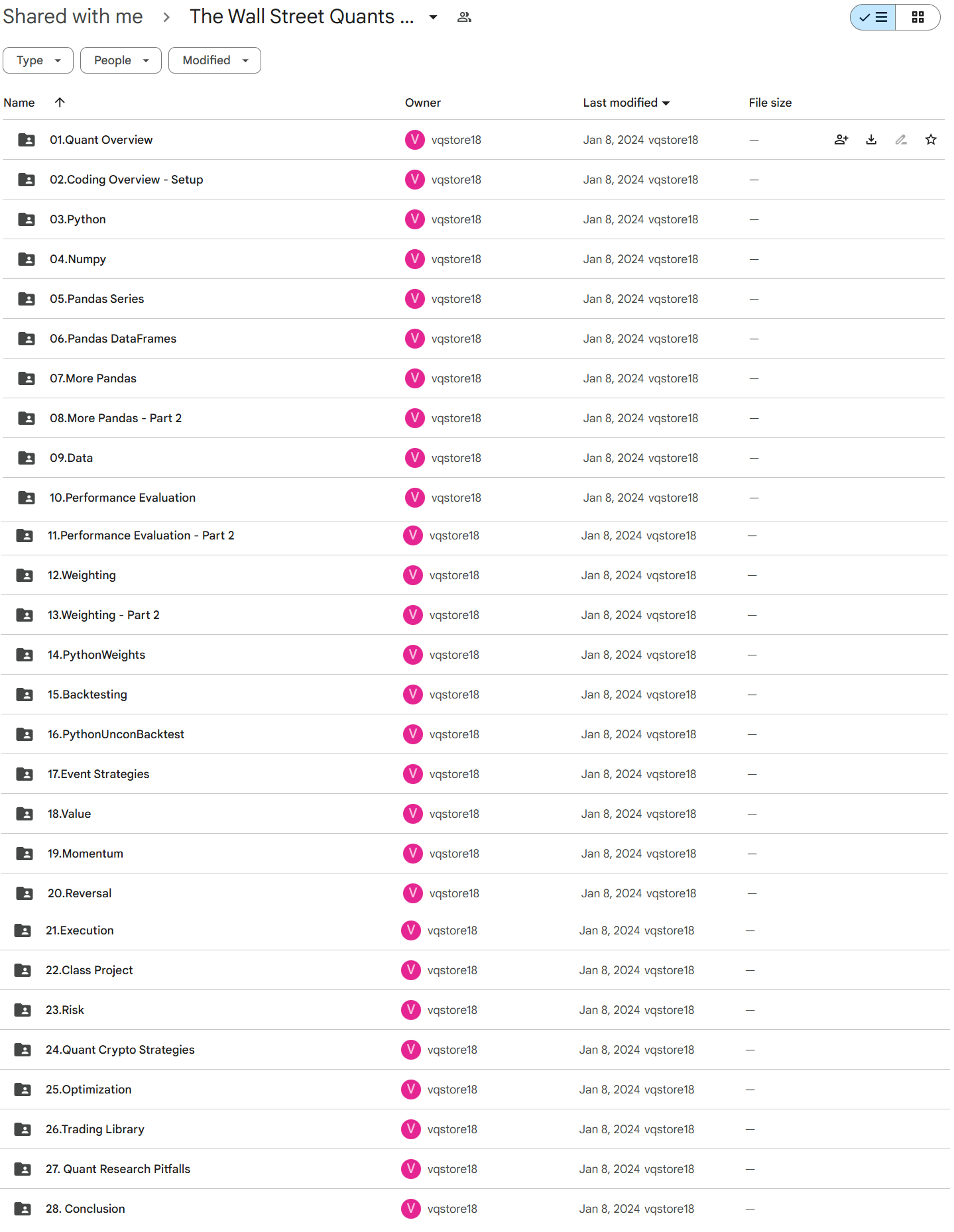

3️⃣. The Wall Street Quants Bootcamp Course Curriculum:

The Wall Street Quants Bootcamp course curriculum takes you from basic quant concepts to advanced trading strategies. Each module builds on the previous one, making it easy to follow even if you’re new to trading. The course curriculum:

- Module 1: Quant Overview

- Module 2: Coding Overview – Setup

- Module 3: Python

- Module 4: Numpy

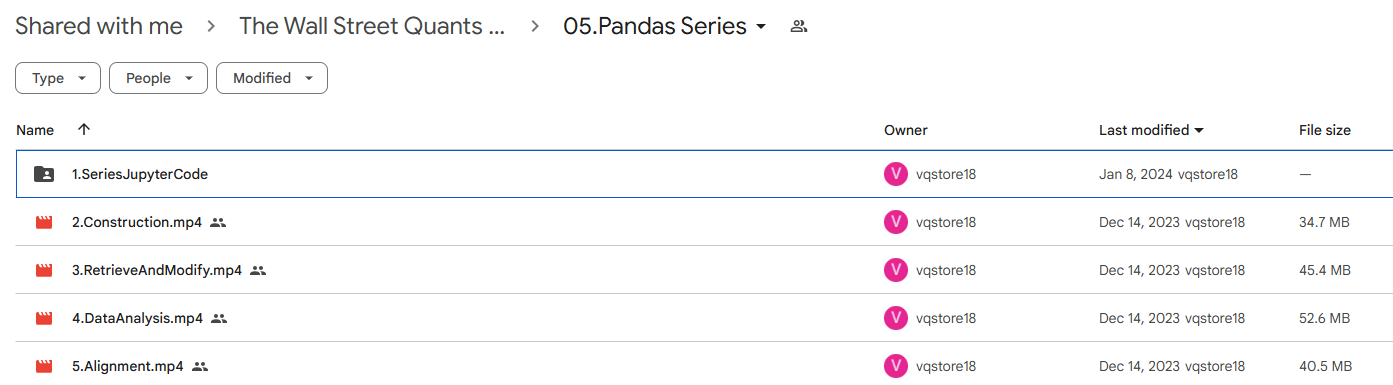

- Module 5: Pandas Series

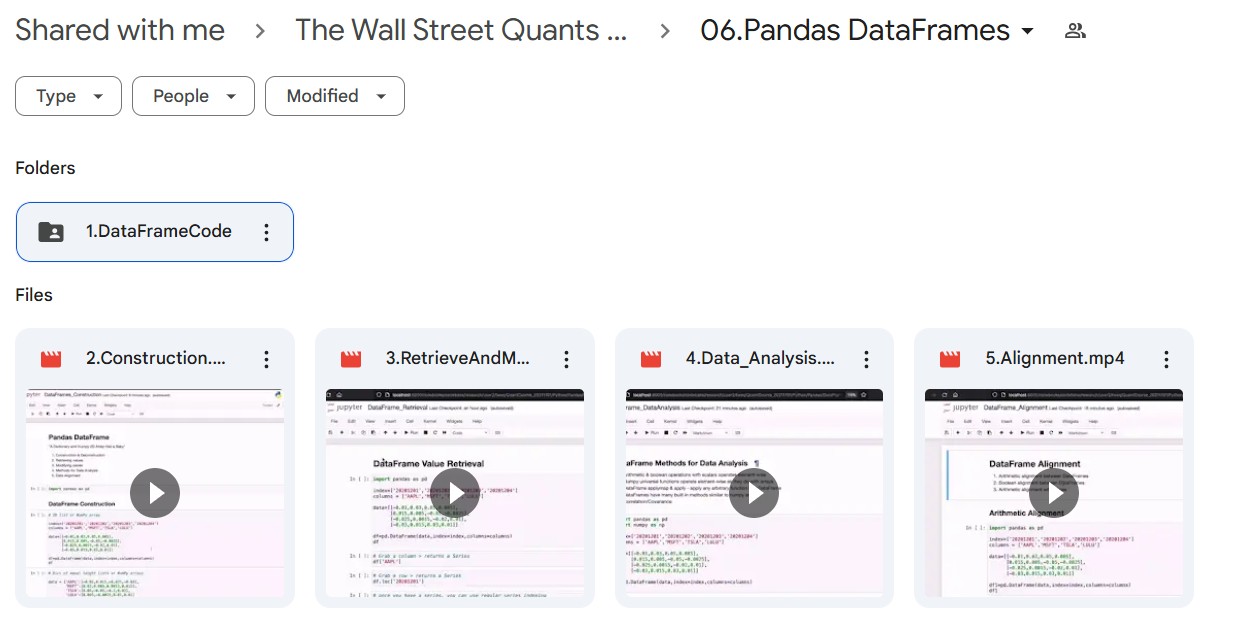

- Module 6: Pandas DataFrames

- Module 7: More Pandas

- Module 8: More Pandas – Part 2

- Module 9: Data

- Module 10: Performance Evaluation

- Module 11: Performance Evaluation – Part 2

- Module 12: Weighting

- Module 13: Weighting – Part 2

- Module 14: PythonWeights

- Module 15: Backtesting

- Module 16: PythonUnconBacktest

- Module 17: Event Strategies

- Module 18: Value

- Module 19: Momentum

- Module 20: Reversal

- Module 21: Execution

- Module 22: Class Project

- Module 23: Risk

- Module 24: Quant Crypto Strategies

- Module 25: Optimization

- Module 26: Trading Library

- Module 27: Quant Research Pitfalls

- Module 28: Conclusion

By the end, you’ll have everything needed to build and run your own trading strategies. Our graduates leave with practical skills they can use right away in real market trading.

4️⃣. What is Wall Street Quants?

Wall Street Quants comprises senior traders from Point72, Millennium, and SIG (Susquehanna International Group). They’ve spent years building profitable strategies at top hedge funds and high-frequency trading firms.

The team specializes in statistical arbitrage, portfolio optimization, and crypto trading. They’ve managed billion-dollar portfolios and built advanced trading systems that make real money in the markets.

Many of their trained students now work at major hedge funds. They teach practical trading skills that firms actually use, not just theory. Their methods focus on what really works in today’s markets.

Their hands-on teaching approach helps you master the exact skills top quant firms want. You’ll learn the same strategies they use to make profits at leading hedge funds.

5️⃣. Who should take Wall Street Quants Course?

This comprehensive quant finance bootcamp is designed for ambitious individuals ready to break into quantitative trading. The course is ideal for:

- Students: Undergraduate and graduate students in mathematics, physics, computer science, or related fields seeking quant roles

- Career Switchers: Technology professionals and engineers looking to transition into quantitative finance

- Current Traders: Traditional traders wanting to upgrade their skills with quantitative methods

- Aspiring Quants: Anyone passionate about algorithmic trading and seeking to build a career in systematic trading

The program accommodates both beginners and experienced professionals, providing a clear path to mastering quantitative trading.

6️⃣. Frequently Asked Questions:

Q1: How much money do you need to start algorithmic trading?

You can start with $5,000, but most successful traders use $25,000-$50,000 to manage risk properly. Many brokers offer paper trading so you can practice without real money first.

Q2: How long does it take to build a profitable trading algorithm?

Most traders need 3-6 months to build and test a profitable strategy. You’ll spend time testing with historical data and paper trading before risking real money. Proper testing is crucial for success.

Q3: What programming skills do you need for algorithmic trading?

Python is essential – 85% of quant firms use it. You need to learn Pandas and NumPy for data analysis. Most successful traders start with basic Python and improve as they build strategies.

Q4: What’s the difference between algorithmic and systematic trading?

Algorithmic trading uses computers to execute trades automatically. Systematic trading follows strict rules to make trading decisions. Most quant traders use both methods together for best results.

Q5: How much do quant traders typically earn?

New quant traders start at $150,000-$200,000 per year. With 3-5 years experience, you can make $300,000-$500,000. Top traders at hedge funds can earn over $1 million with bonuses.

Be the first to review “The Wall Street Quants Bootcamp” Cancel reply

You must be logged in to post a review.

Related products

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Trading Courses

Reviews

There are no reviews yet.